Accounting Contract Template

Streamline your agreement process and establish clear terms and conditions for your accounting services, ensuring a strong and beneficial professional relationship. Simplify the complexities of contract writing and enhance your chances of securing valuable accounting contracts with our comprehensive template.

From financial reporting to tax preparation, our customizable template provides the essential framework for a robust accounting contract. Elevate your accounting services and stand out from the competition by utilizing this unique resource designed to boost your contracting success.

What is an Accounting Contract?

An Accounting Contract is a crucial agreement that solidifies the partnership between a business and an accounting service provider. This legal document outlines the terms and conditions under which the accounting services will be rendered, ensuring clarity and accountability.

By utilizing an Accounting Contract, businesses can ensure accurate financial record-keeping, compliance with relevant laws and regulations, and timely reporting. The contract establishes the scope of services, including financial statement preparation, tax planning, audit support, and other accounting-related tasks.

Moreover, with the help of contracts, businesses can protect their financial interests and establish a professional working relationship with their chosen accounting service provider. The contract provides a clear framework for collaboration, ensuring that both parties understand their roles and obligations.

An Accounting Contract is an essential tool for businesses seeking professional accounting services. It helps ensure accurate financial management, regulatory compliance, and informed decision-making, ultimately contributing to the growth and success of the organization.

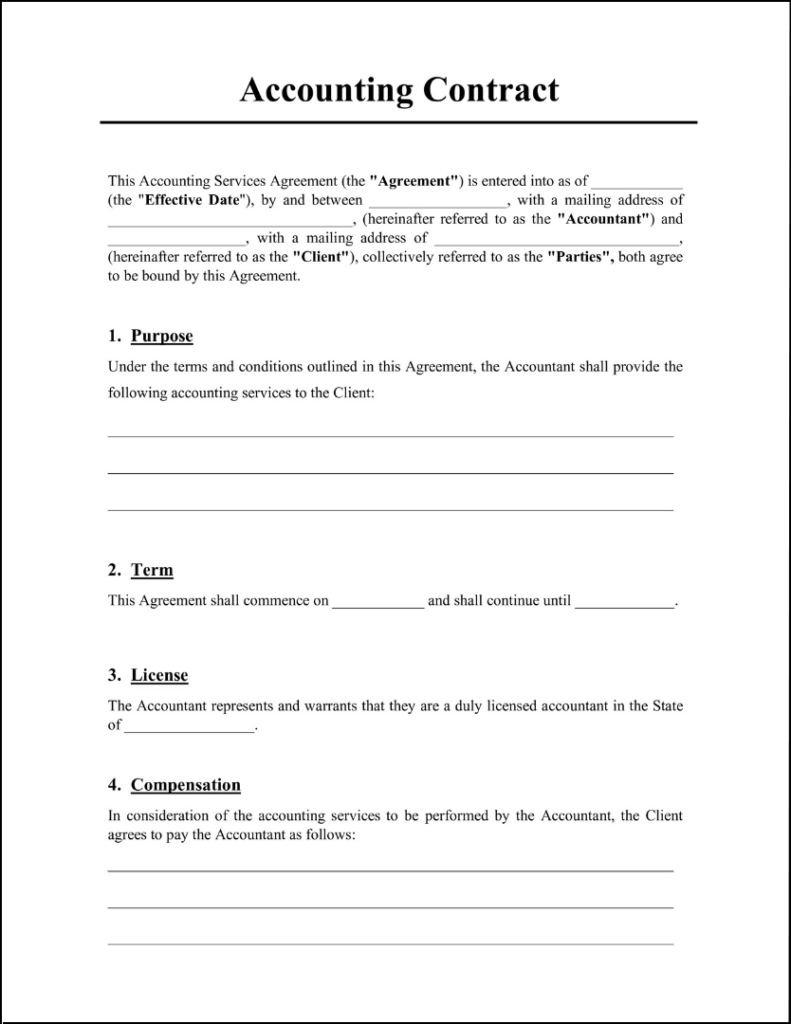

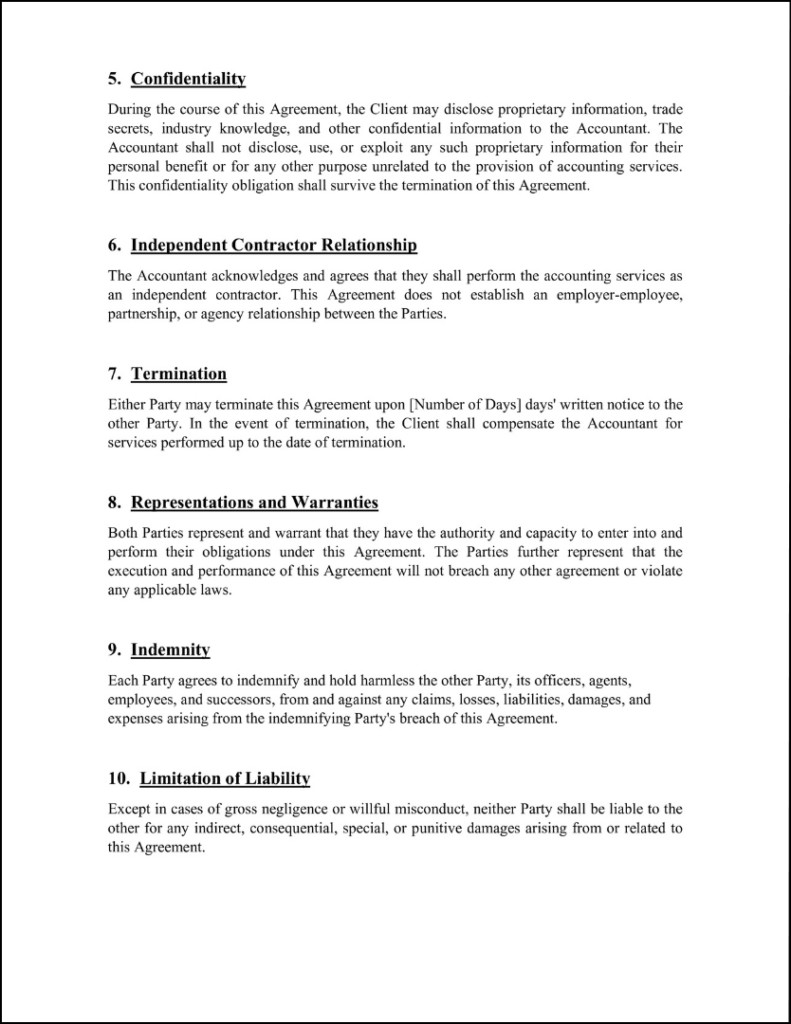

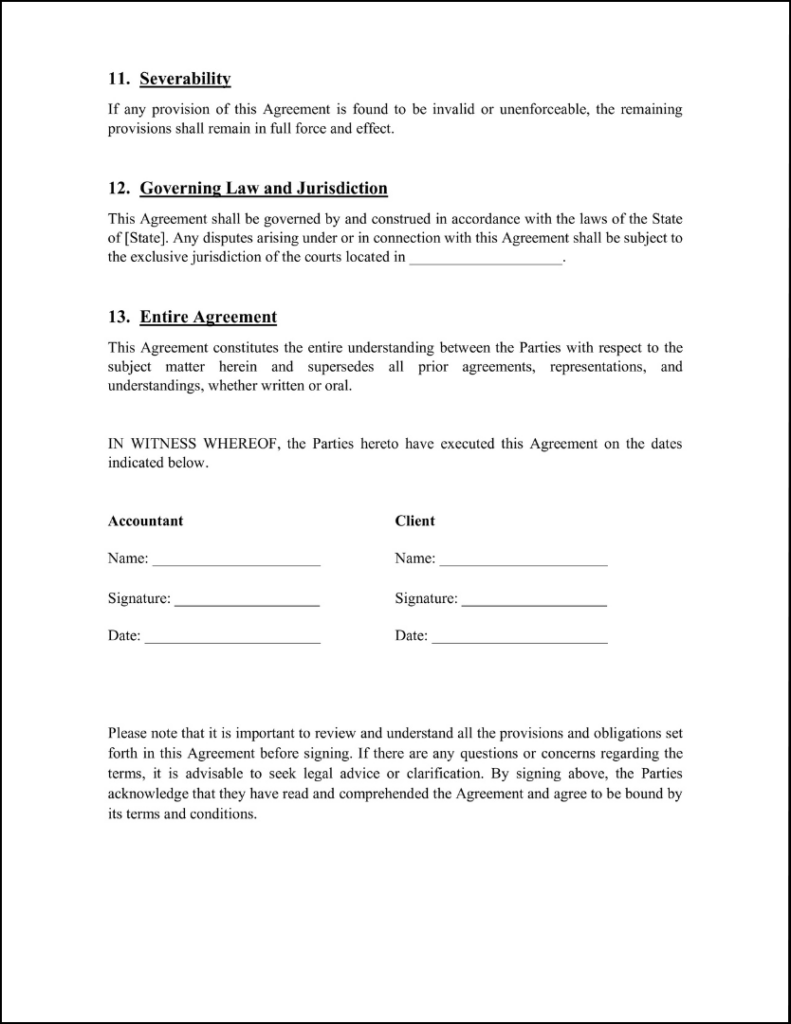

Free Editable Accounting Contract Sample

Access our free Accounting Contract sample to safeguard your interests. Download now and take proactive steps toward a secure Accounting Contract at no cost.

Key Components of an Accounting Contract

When entering into an accounting contract, it is essential to establish clear and comprehensive terms to ensure a successful and mutually beneficial partnership. The following key components are crucial to include in an Accounting Contract:

- Scope of Services

- Duration of Engagement

- Fees and Payment Terms

- Responsibilities of the Accounting Service Provider

- Client Responsibilities

- Confidentiality and Data Security

- Termination Clause

- Dispute Resolution

- Governing Law and Jurisdiction

- Amendments and Modifications

5 Tips for Writing an Accounting Contract

Crafting a comprehensive and well-structured accounting contract is vital for establishing clear expectations and protecting the interests of both parties involved. Here are five tips to help you create a unique and effective accounting contract:

1. Understand the client’s needs

Before drafting the accounting contract, take the time to understand your client’s specific requirements and objectives. Conduct thorough research to identify their financial goals, industry-specific regulations, and any other relevant factors. This knowledge will enable you to tailor the contract to address their specific needs, showcasing your ability to provide customized accounting solutions.

2. Keep it clear and concise

When writing the accounting contract, use clear and straightforward language that avoids complex jargon. Organize the contract into logical sections and ensure that each clause is easy to understand. By presenting the information in a clear and concise manner, you make it easier for both parties to grasp the terms and conditions, fostering a transparent and productive working relationship.

3. Showcase your expertise

Highlight your expertise and experience in the accounting field within the contract. Mention any relevant certifications, qualifications, or specialized training you possess. You may also include brief summaries of past successful projects or testimonials from satisfied clients. By demonstrating your expertise, you instill confidence in the client and establish yourself as a trusted and competent accounting professional.

4. Specify pricing and payment terms

Clearly outline the pricing structure and payment terms within the contract. Include details about your hourly rates, fees for additional services, and any circumstances that may result in extra charges. Specify the billing cycle and provide information on acceptable payment methods. By being transparent about pricing, you foster trust with your client and minimize the potential for future disputes.

5. Leverage technology for efficiency

Embrace technology to streamline the accounting contract process. Utilize digital solutions like BunnyDoc to create, send, and track your accounting contracts efficiently. BunnyDoc ensures secure document storage and enables both parties to sign contracts electronically, saving time and resources. By incorporating technology into your contract workflow, you demonstrate professionalism and efficiency to potential clients.

FAQs Related to Accounting Contract Templates

Accounting Contract Sample Preview

Below is the downloadable sample of an Accounting Contract:

Disclaimer: Please note that the samples provided here are intended to serve as a helpful resource and should not be considered legal advice. It is important to consult with a qualified attorney or legal professional to ensure that any modifications or usage of these templates align with the specific laws and regulations applicable to your jurisdiction and circumstances. BunnyDoc disclaims any liability or responsibility for the consequences arising from the use or customization of these templates. It is the responsibility of the users to review and adapt these templates to their specific needs, and to seek legal counsel for their particular circumstances.