Loan Agreement Template

In the world of finance, loans play a crucial role in enabling individuals and businesses to achieve their financial goals. When entering into a loan agreement, it is essential to have a well-structured and legally binding document that outlines the terms and conditions of the loan. To simplify this process, many individuals and organizations use loan agreement templates.

This guide offers invaluable information and a complimentary Loan Agreement template, designed to assist you in effortlessly navigating through the process. Gain valuable insights and download the template now to simplify your journey.

What is a Loan Agreement?

A Loan Agreement is a legally binding contract that outlines the terms and conditions of a loan between a lender and a borrower. It sets forth the details of the loan, including the loan amount, interest rate, repayment schedule, and any other relevant terms. The agreement serves as a means of formalizing the lending arrangement and helps to protect the rights and obligations of both parties involved. It ensures clarity and transparency regarding the loan transaction, reducing the potential for misunderstandings or disputes.

Elements of a Loan Agreement Template

A loan agreement template typically includes the following essential elements:

- Loan Amount

- Interest Rate

- Repayment Terms

- Security or Collateral

- Default and Remedies

- Governing Law

- Termination Clause and much more.

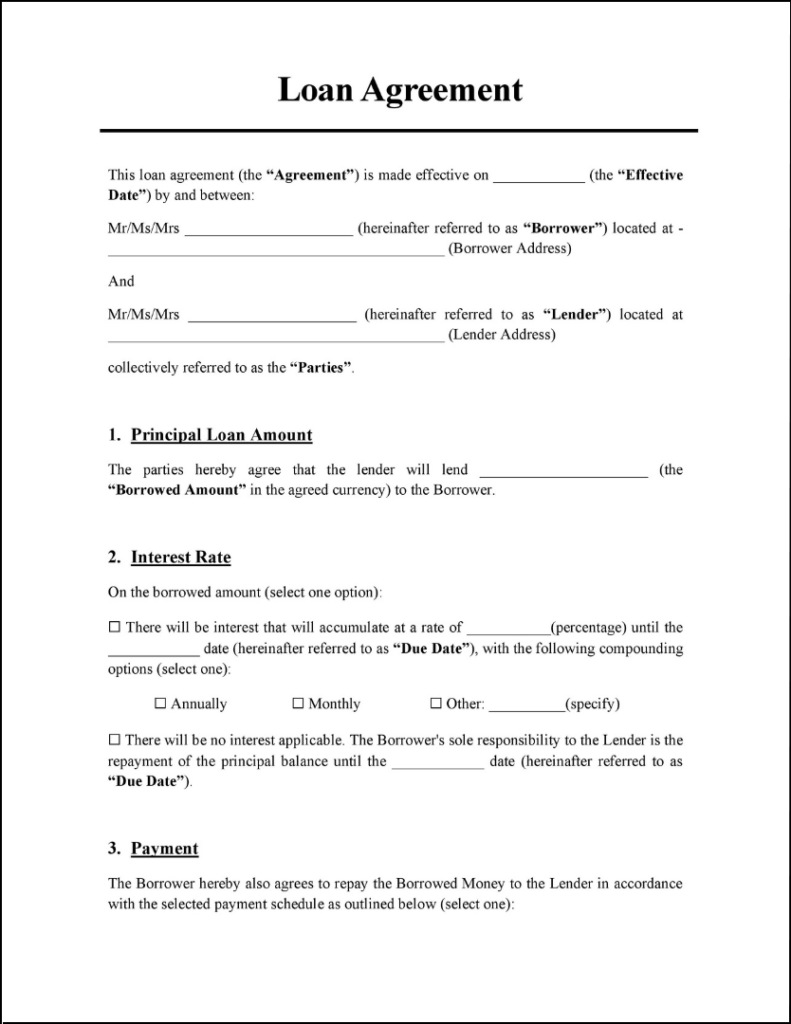

Free Editable Loan Agreement Sample

Access our free loan agreement sample to safeguard your interests. Download now and take proactive steps toward a secure loan agreement at no cost.

The Benefits of a Well-Structured Loan Agreement Template

In the realm of financial transactions, the utilization of a loan agreement template emerges as a pragmatic approach. This standardized framework not only expedites the lending process by clearly delineating repayment structures and interest terms but also minimizes the potential for misunderstandings and legal conflicts. Such templates thus present a mutually advantageous scenario, enhancing risk management for lenders while providing borrowers with a well-defined borrowing structure. Using a loan agreement template offers several benefits for both lenders and borrowers let’s take a look at some:

Legal Protection

A loan agreement template helps protect the interests of both parties involved in the loan transaction. It clearly outlines the terms, conditions, and repayment terms, ensuring that both parties are aware of their rights and obligations.

Clarity and Understanding

A well-drafted loan agreement template eliminates ambiguity and confusion by clearly stating every point. This clarity ensures that both parties have a thorough understanding of the loan terms.

Time and Cost Savings

Creating a loan agreement from scratch can be a time-consuming and costly process. By using a template, lenders and borrowers can save valuable time and resources, as the template provides a ready-made structure that can be customized quickly.

Professionalism

A loan agreement template gives a professional touch to the loan transaction. It demonstrates that the parties involved are serious about the terms and conditions of the loan, creating a sense of professionalism and trust.

Free Editable Loan Agreement Sample

Access our free loan agreement sample to safeguard your interests. Download now and take proactive steps toward a secure loan agreement at no cost.

5 Tips for Writing a Loan Agreement

A well-written loan agreement is a fundamental component of any financial transaction, providing clarity and protection for all parties involved. Whether you’re a lender extending credit or a borrower seeking funds, crafting a thorough and precise loan agreement is crucial to ensure the smooth execution of the loan. To help you navigate this important task, here are five valuable tips to consider when writing a loan agreement. By following these recommendations, you can enhance transparency, mitigate risks, and establish a solid foundation for a successful lending relationship.

1. Clearly Define Terms and Conditions

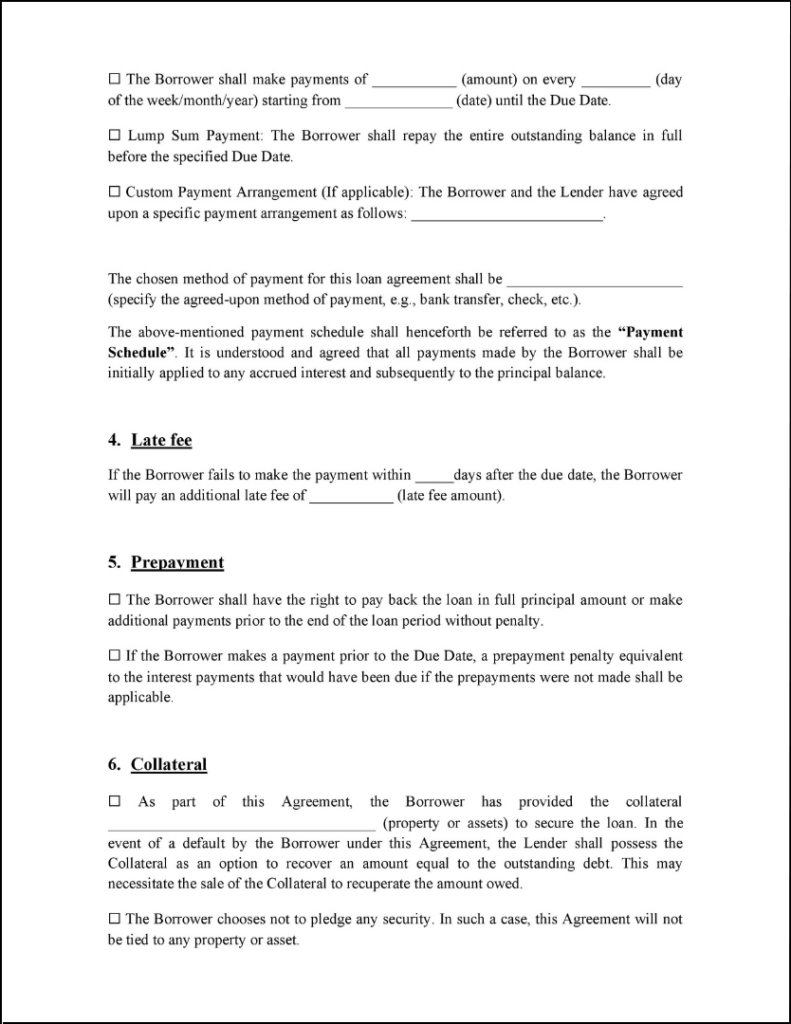

Ensure that your loan contract includes a clear and comprehensive description of the terms and conditions of the loan. This includes specifying the loan amount, interest rate, repayment schedule, late payment penalties, and any additional fees or charges. By clearly defining these terms, both parties will have a clear understanding of their rights and obligations.

2. Include Detailed Repayment Terms

Outline the repayment terms in detail, including the frequency and method of repayment. Specify whether the repayment will be made in instalments or as a lump sum and provide a clear timeline for repayment. Be sure to include any provisions for early repayment or refinancing options if applicable.

3. Define Collateral and Security Measures

If the loan is secured by collateral, clearly identify the assets that will serve as security. Describe the conditions under which the lender can seize or sell the collateral in the event of default. Additionally, if any third-party guarantees or co-signers are involved, clearly state their roles and responsibilities.

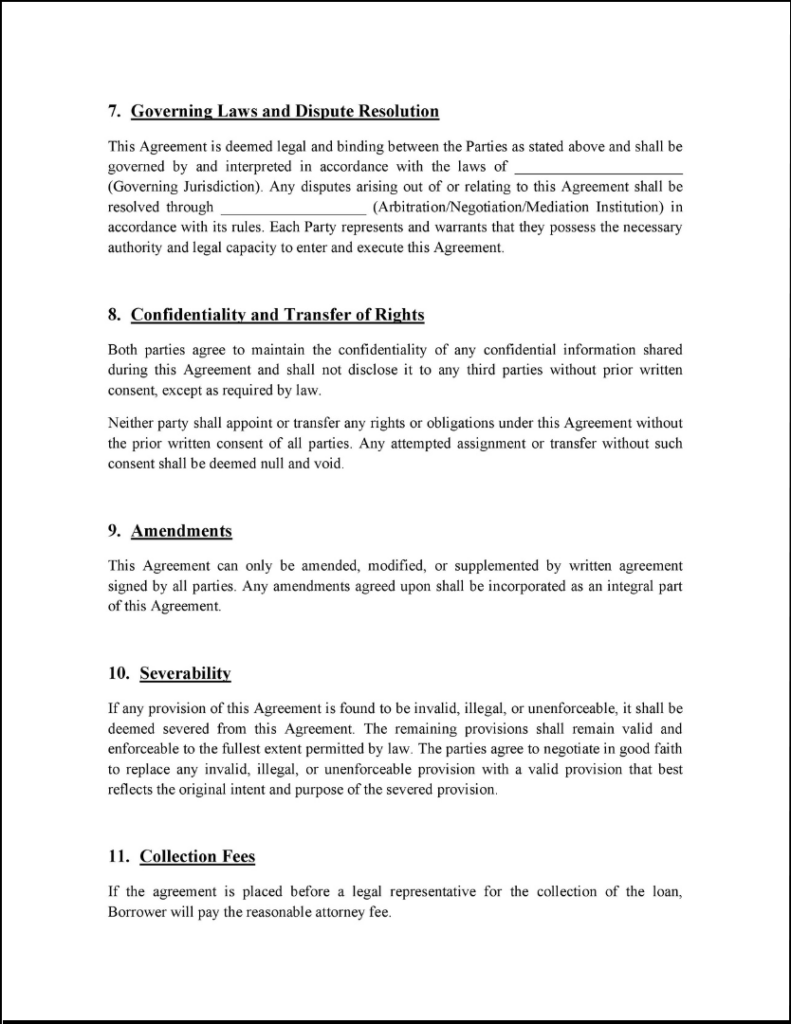

4. Address Default and Remedies

Define the conditions under which the loan will be considered in default and outline the remedies available to the lender. This may include imposing late payment fees, accelerating the loan, or pursuing legal action. Similarly, outline the borrower’s rights and options in the event of a dispute or disagreement.

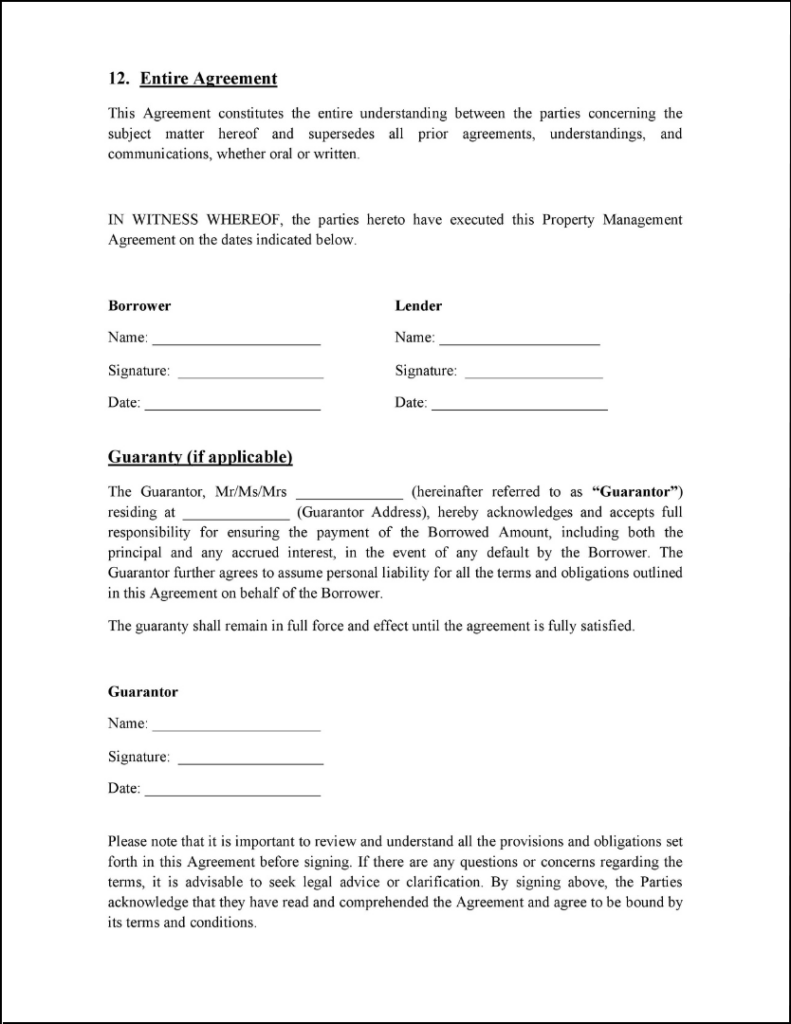

5. Seek Legal Advice and Documentation

It is highly recommended to seek legal advice when drafting a loan agreement to ensure compliance with relevant laws and regulations. Utilize a loan agreement template or consult an attorney to ensure that all necessary clauses and provisions are included and that the document is legally binding. Keep thorough records and ensure that all parties involved sign and retain copies of the loan agreement for future reference.

FAQs Related to Loan Agreements

Disclaimer: Please note that the samples provided here are intended to serve as a helpful resource and should not be considered legal advice. It is important to consult with a qualified attorney or legal professional to ensure that any modifications or usage of these templates align with the specific laws and regulations applicable to your jurisdiction and circumstances. BunnyDoc disclaims any liability or responsibility for the consequences arising from the use or customization of these templates. It is the responsibility of the users to review and adapt these templates to their specific needs, and to seek legal counsel for their particular circumstances.