Looking for the best invoicing software for your business? Whether you’re a small business owner, a freelancer, or part of a larger organization, finding the right invoicing and accounting solution is crucial for efficient financial management. Invoicing softwares simplifies the process of generating and managing invoices, making it easier for businesses to keep track of their financial transactions. These tools often come equipped with customizable templates, automated billing, and integration capabilities, enabling businesses to streamline their invoicing procedures and improve overall efficiency.

We’ll provide a detailed overview of each alternative, highlighting their key features, pros, and cons, to help you make an informed decision for your business. Whether you’re looking for a free invoicing solution or comprehensive accounting software, our guide will assist you in finding the perfect fit to streamline your financial operations and maintain accurate records. With a diverse range of options available, you can find invoicing software that suits your business-specific needs and budget constraints.

1. Wave Invoicing Overview

Wave invoicing is a popular and user-friendly invoicing solution that offers a range of features for businesses and freelancers. Founded in 2010, Wave has gained a reputation for its accessibility and affordability, making it an attractive option for small businesses and self-employed professionals. The platform is known for its cloud-based nature, which means users can access their invoicing and accounting data from anywhere with an internet connection.

One of Wave’s standout features is its free pricing tier, which includes access to invoicing tools. Users can create and customize professional invoices, add their company logo, and include itemized lists of products or services provided. Wave also supports recurring invoices, making it convenient for businesses with subscription-based models. Furthermore, the platform allows you to track invoice statuses, send reminders for overdue payments, and even accept online payments, making it easier to get paid faster.

In addition to invoicing, Wave offers accounting features like expense tracking, bank reconciliation, and financial reporting. Users can connect their bank accounts and credit cards to automatically import transactions, simplifying the bookkeeping process. The reporting tools provide insights into your business’s financial health, helping you make informed decisions. Wave’s commitment to simplicity and accessibility has made it a valuable tool for small businesses and freelancers looking for an invoicing and accounting solution without a steep learning curve or a hefty price tag.

Pros

- No cost

- Robust accounting capabilities

- Effective invoicing tools

- Built-in eCommerce checkout functionality

- Highly-praised by customers

- Comprehensive support resources

- Seamless Etsy integration

Cons

- Lacks project management features

- Restricted time tracking capabilities

- Limited integration options

- Absence of multi-user support

2. Quickbooks Online

QuickBooks Online is a leading cloud-based accounting and financial management software designed to meet the diverse needs of businesses of all sizes. Developed by Intuit, QuickBooks Online has garnered a reputation as one of the most comprehensive and user-friendly accounting solutions on the market. With its robust set of features, it empowers businesses to streamline their financial processes, from invoicing and expense tracking to payroll management and tax preparation.

One of the standout features of QuickBooks Online is its versatility. It caters to various industries and business types, offering customizable templates for invoices and reports. Users can easily create professional invoices, track expenses, and reconcile bank transactions, ensuring accurate and up-to-date financial records. QuickBooks Online also supports multi-user access, making it suitable for collaborative environments, and it offers a wide range of integrations with popular apps and services, further enhancing its functionality. Additionally, it provides access to real-time financial insights and reporting tools, empowering businesses to make informed decisions and maintain financial stability.

QuickBooks Online Features

- Invoicing

- Expense Tracking

- Bank Reconciliation

- Financial Reporting

- Multi-User Access

- Integration Capabilities

- Payroll Management

- Tax Preparation

- Inventory Management

- Time Tracking

Pros

- Free Trial

- An advanced array of features

- Mobile apps

- Extensive integrations

Cons

- Limited customer support

- High cost

- Occasionally not user-friendly

3. Zoho Invoice

Zoho Invoice is a user-friendly online invoicing software designed to simplify billing and invoicing processes for businesses of all sizes. Developed by Zoho Corporation, known for its suite of business software solutions, Zoho Invoice stands out for its intuitive interface and feature-rich capabilities. Whether you’re a freelancer, small business owner, or part of a larger organization, Zoho Invoice offers a range of tools to help you create and manage invoices efficiently.

One of Zoho Invoice’s notable features is its customizable invoicing templates, allowing users to create professional and branded invoices. It supports multiple currencies and tax regulations, making it suitable for businesses with international clients. Additionally, it offers time tracking, expense management, and automated recurring billing features. Zoho Invoice integrates seamlessly with other Zoho apps, such as Zoho Books and Zoho CRM, providing a comprehensive solution for businesses to manage their financial operations and customer relationships. With its cloud-based nature, users can access their invoicing data from anywhere, making it a convenient choice for on-the-go entrepreneurs and remote teams. Overall, Zoho Invoice offers a versatile invoicing solution with the tools necessary to streamline your billing processes and maintain accurate financial records.

Zoho Books Features

- Invoicing and Estimates

- Expense Tracking

- Time Tracking

- Online Payments

- Automated Payment Reminders

- Client Portal

- Multi-Currency Support

- Reporting and Analytics

- Expense Receipts

- Customizable Templates

Pros

- No Cost

- Invoicing Efficiency

- Online Payment Options

- Automated Reminders

- Client Portal Access

- Multi-Currency Support

- Customizable Templates

- Mobile Accessibility

- Integration Capabilities

Cons

- Limited Advanced Features

- No Full Accounting Suite

- Limited Customer Support

- Integration Complexity

- Mobile App Limitations

- No Offline Access

4. Xero

Xero is a cloud-based accounting software platform that has gained widespread recognition for its versatility and user-friendly approach to financial management. Founded in New Zealand in 2006, Xero has become a trusted tool for businesses of all sizes, from freelancers and startups to established enterprises. One of Xero’s distinguishing features is its real-time financial visibility, providing users with up-to-the-minute insights into their financial health. It offers a wide range of functionalities, including invoicing, expense tracking, bank reconciliation, and payroll management, making it a comprehensive solution for businesses seeking to streamline their accounting processes.

Xero’s accessibility is a key selling point, allowing users to access their financial data from anywhere with an internet connection. Its intuitive dashboard provides an overview of income, expenses, and cash flow, enabling informed decision-making. Xero’s extensive integration capabilities ensure seamless connectivity with other business tools, apps, and banking services, enhancing its adaptability to various business needs. Moreover, it supports multiple users, making it suitable for collaborative environments, and offers customizable templates for invoices and reports. Whether you’re a small business owner, accountant, or bookkeeper, Xero empowers you to efficiently manage your financial operations while maintaining accuracy and compliance.

Xero Features

- Invoicing and Quotes

- Expense Tracking

- Bank Reconciliation

- Financial Reporting

- Inventory Management

- Fixed Assets Management

- Purchase Orders

- Fixed Assets Management

- Project Accounting

Pros

- Real-Time Financial Insights

- User-Friendly Interface

- Extensive Integrations

- Multi-User Support

- Cloud-Based Accessibility

- Mobile App

- Scalability for Growing Businesses

Cons

- Limited Offline Access

- No Full Project Management

- May Not Suit Highly Specialized Businesses

- Additional Costs for Some Features

5. Invoice Ninja

Invoice Ninja is a versatile and user-friendly invoicing and billing platform designed to cater to the needs of freelancers, small businesses, and entrepreneurs. This open-source software provides a comprehensive suite of tools for creating and managing invoices, estimates, and payments efficiently. One of its standout features is the ability to fully customize invoice templates to reflect your brand, creating a professional and consistent image. Invoice Ninja also supports multiple languages and currencies, making it suitable for businesses with international clients.

Additionally, Invoice Ninja offers features such as expense tracking, time tracking, and project management, making it a holistic solution for managing your financial and project-related tasks. It includes online payment processing capabilities, allowing you to receive payments securely through various payment gateways. The platform’s reporting and analytics tools provide valuable insights into your business’s financial performance. With its self-hosted option and cloud-based version, Invoice Ninja offers flexibility and accessibility to suit your specific business needs, all while maintaining an easy-to-navigate interface that simplifies your invoicing and billing processes.

Invoice Ninja Features

- Customizable Invoices

- Online Payment Processing

- Expense Tracking

- Time and Project Management

- Multi-Language and Currency Support

- Client Portal Access

- Recurring Billing

Pros

- Flexible Hosting

- Multi-Language

- Robust Reporting

- Online Payment Convenience

- Mobile Accessibility

Cons

- Steep learning curve

- Limited mobile app

- Insufficient branding options

- Limited customer support

6. FreshBooks

FreshBooks is a widely recognized and user-friendly accounting and invoicing software tailored primarily for freelancers, small business owners, and self-employed professionals. Since its inception in 2003, FreshBooks has made significant strides in simplifying financial management processes. One of its standout features is its intuitively designed platform, making it easy for users to navigate and utilize its extensive range of financial tools. FreshBooks places a strong emphasis on streamlining invoicing and billing tasks, offering customizable templates, automated payment reminders, and secure online payment processing to ensure prompt and hassle-free payments from clients.

In addition to its robust invoicing capabilities, FreshBooks provides an array of features that cater to the broader financial needs of small businesses. These include expense tracking, time tracking, project management, and comprehensive reporting. The software’s user-friendly mobile app enhances accessibility, allowing users to manage their financial tasks on the go. FreshBooks also offers integrations with popular apps and services, enhancing its functionality and adaptability to diverse business requirements. With its commitment to simplifying financial management, FreshBooks has earned its reputation as an efficient and reliable solution for businesses seeking to maintain accurate financial records and optimize their invoicing and accounting processes.

Freshbooks Features

- Invoicing

- Payments

- Time Tracking

- Accounting

- Expenses & Receipts

- Reports

- Mileage Tracking App

- Bookkeeping

- Projects

- Proposals

- Estimates

- Clients

- Payroll

- Mobile Apps

Pros

- Mobile app

- User-Friendly

- Time Tracking

Cons

- Expensive

- Limited Plans

- Basic Accounting Features

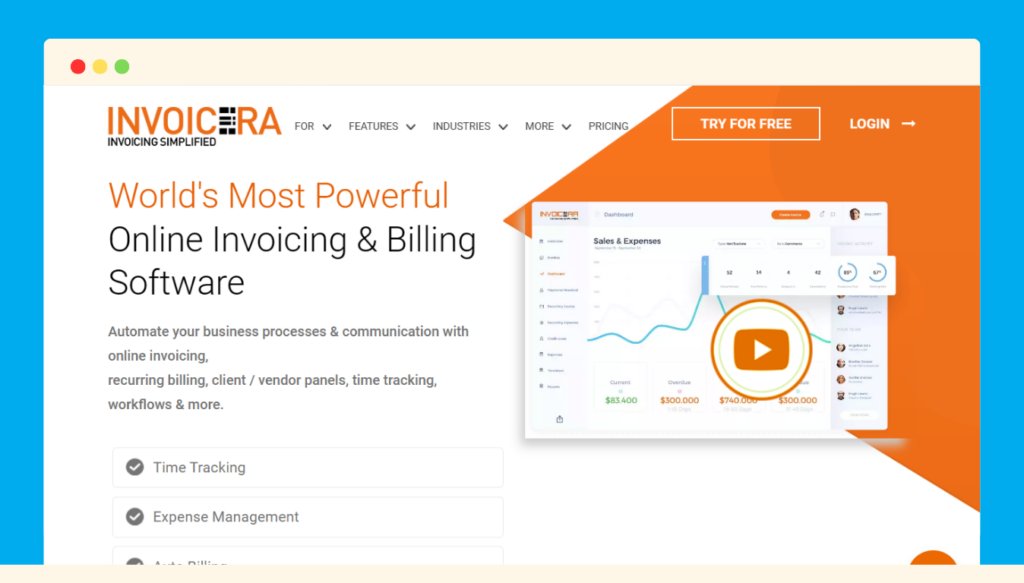

7. Invoicera

Invoicera is a robust invoicing and billing software solution that caters to businesses of various sizes and industries. Established in 2006, Invoicera has steadily gained recognition for its comprehensive set of invoicing features and its commitment to simplifying financial management. One of its distinguishing features is its versatility, making it suitable for freelancers, small businesses, and large enterprises alike. Invoicera offers a user-friendly interface that ensures easy navigation and utilization of its powerful financial tools.

Invoicera excels in streamlining the invoicing process, allowing users to create customized invoices, estimates, and quotes effortlessly. It offers multi-currency support, facilitates international transactions, and provides various payment gateways for secure online payments. Additionally, Invoicera offers a range of financial management features, including expense tracking, time tracking, project management, and reporting. The software’s ability to generate insightful financial reports ensures businesses have a clear understanding of their financial performance. With integration options and mobile accessibility, Invoicera aims to provide a comprehensive solution for businesses seeking to improve their invoicing efficiency and maintain precise financial records.

Invoicera Features

- Multi – Business Handling

- Online Invoicing

- Online Payments

- Subscription Billing

- Staff Management

- Multi-Currency & Multi-Lingual

- AR & AP Management

- Estimate (Pre-designed templates) Management

- Project Management

- Mobile app

- Time Tracking

- Expense Management

- Financial Forecasting

- Client Management

- Integrate With Legacy Systems

- Create Custom workflow

- Task Management

- Credit Note Management

- Template Customization

Pros

- Free Trial

- Multilingual functionality

Cons

- Limited number of users on the free version

- Lack of advanced Features

- High monthly costs on top-tier plans

8. Kashoo

Kashoo is a cloud-based accounting software designed to simplify financial management for small businesses and freelancers. Since its establishment in 2008, Kashoo has been committed to offering straightforward and user-friendly accounting solutions. It stands out for its accessibility and ease of use, making it a valuable choice for individuals and businesses seeking to maintain accurate financial records without the complexity associated with more robust accounting platforms.

Kashoo excels in its core accounting functions, allowing users to manage their income, expenses, and bank reconciliations efficiently. Its streamlined invoicing and billing features include customizable invoice templates, payment processing options, and recurring invoicing capabilities. Kashoo also offers comprehensive reporting tools that provide insights into a business’s financial performance. With its intuitive interface and mobile accessibility, Kashoo is a practical choice for those who prioritize simplicity in their financial management processes.

Kashoo Features

- Cloud-based solution

- Exceptional mobile app

- Multiple currencies

- Integrations

- Multiple users and unlimited projects

- Take pictures of receipts

- Full bank reconciliation

- View cash flow

- Create and send invoices and accept payments

- Create and print paper checks

- Track expenses and income

- Do end-of-year accounting

- Real-time view of finances

- Accountant access

Pros

- User-Friendly

- Affordable

- Free Trial

- Unlimited users included.

Cons

- Lacking advanced features like inventory, estimates and time tracking.

- Limited integration options.

- No Mobile app

9. Sage Accounting

Sage Accounting, formerly known as Sage One, is a cloud-based accounting software solution designed to assist small businesses and startups in managing their finances effectively. With a strong global presence and a reputation for reliability, Sage Accounting offers a comprehensive set of accounting tools that simplify financial management tasks. Sage has a long history of providing accounting solutions, and Sage Accounting is designed to continue this legacy by offering intuitive features that cater to businesses of varying sizes.

One of the standout features of Sage Accounting is its user-friendly interface, which allows users to navigate the platform with ease. The software covers essential accounting functions, including invoicing, expense tracking, bank reconciliation, and financial reporting. Sage Accounting also provides multi-currency support, making it suitable for businesses with international operations. Additionally, it offers seamless integration with various banking services, reducing manual data entry. With its mobile accessibility and secure data storage, Sage Accounting aims to be a reliable and efficient tool for businesses seeking to maintain financial accuracy and compliance.

Sage Accounting Features

- Mac compatible

- Accounts receivable

- Bank connections

- Mobile app

- Integrate invoice payments

- Accounts payable

- Invoicing

- Reporting

- Multi-currency

- Payments

- Stock management

- Billing

- Invoice templates

Pros

- Affordable

- Unlimited users

- Robust inventory tracking

- Phone support

- Free Trial

Cons

- No Free Plan

- Limited Integrations

- No Time Tracking Features

10. Invoicely

Invoicely is a versatile invoicing and billing platform designed to serve freelancers, small businesses, and self-employed professionals in managing their financial transactions effectively. Founded in 2013, Invoicely has gained recognition for its simplicity and efficiency. The platform offers a range of tools to streamline the invoicing process, helping users create and send professional invoices to clients with ease. Invoicely is known for its accessibility and affordability, making it an attractive option for individuals and small businesses looking to enhance their financial management.

One of Invoicely’s standout features is its user-friendly interface, which requires no prior accounting knowledge to navigate. Users can create customizable invoices, estimates, and recurring invoices, simplifying the billing process. Invoicely also supports various payment gateways, ensuring secure and timely payments from clients. Additionally, it offers expense tracking, time tracking, and financial reporting features to provide users with a holistic view of their financial performance. With mobile accessibility and the ability to manage multiple businesses within a single account, Invoicely aims to be a practical solution for users seeking efficient invoicing and financial management.

Invoicely Features

- Effortless Invoicing

- Accept Online Payments

- Track Time, Expenses & Mileage

- Make Your Brand Stick Out

- Manage Multiple Businesses

- Dynamically Generated Reports

- Monthly and Yearly Statements

- Income and Expenditure Summaries

- Accounts Receivable and Payable

Pros

- Free Plan

- Multi-language support

- User-Friendly

- Multiple Currencies

Cons

- Lack of Advanced Feature

- Limited integrations

- Limited invoice customization

- No Free Trial

11. Invoice Berry

Invoice Berry is a straightforward invoicing and expense-tracking software designed for small businesses, freelancers, and sole proprietors. Established in 2010, Invoice Berry offers a simple and efficient platform for creating and sending invoices, managing expenses, and tracking payments. It is known for its user-friendly approach, making it accessible to users with limited accounting expertise. Invoice Berry’s primary focus is on simplifying financial tasks, making it a practical choice for those who prioritize ease of use.

One of the notable features of Invoice Berry is its streamlined invoicing process. Users can easily create and customize invoices, add branding elements, and send them to clients. The platform supports online payments, enabling clients to pay invoices securely and conveniently. Invoice Berry also includes expense tracking, allowing users to categorize and record expenses for accurate financial records. With its time-saving features and accessibility, Invoice Berry aims to be a valuable tool for individuals and small businesses seeking efficient invoicing and expense management.

Invoice Berry Features

- Tax Calculator

- Payment Reminders

- Quotes (Estimates)

- Payment Processing

- Contact Database

- Recurring (Subscription Billing)

- Online Payments

- Online Invoicing

- Invoice History

- Customizable Invoices

- Customer Portal

- Multi-Currency

Pros

- Free Trial

- Affordable

- Personalized customer invoices

- Reports and monitoring of payment processes

Cons

- Lack of some advanced features

- No Free Plan

- No Yearly Plan

Why is Accounting and Invoicing Software Important in Business Operations?

Accounting software plays a pivotal role in the efficient and effective operation of businesses across various industries. Its importance cannot be overstated, and here are several key reasons why accounting software is crucial in business operations:

1. Accurate Financial Records: Accounting software ensures that businesses maintain precise and up-to-date financial records. It automates the recording of income, expenses, and transactions, reducing the risk of errors associated with manual data entry. This accuracy is vital for making informed financial decisions and complying with tax regulations.

2. Time Savings: With accounting software, routine financial tasks like invoicing, expense tracking, and bank reconciliations can be automated. This saves valuable time that can be redirected toward core business activities, leading to increased productivity.

3. Financial Reporting: Accounting software generates comprehensive financial reports and statements quickly. These reports provide insights into a business’s financial health, enabling owners and managers to identify trends, assess performance, and make strategic decisions.

4. Tax Compliance: Tax laws and regulations can be complex and ever-changing. Accounting software can help businesses stay compliant by tracking and reporting taxes accurately. It simplifies the tax preparation process and minimizes the risk of costly tax errors or audits.

5. Budgeting and Forecasting: Many accounting software solutions offer budgeting and forecasting features. These tools enable businesses to plan for the future, set financial goals, and monitor progress toward those goals. This proactive approach enhances financial stability and growth potential.

6. Cash Flow Management: Effective cash flow management is essential for business survival. Accounting software helps monitor cash inflows and outflows, allowing businesses to optimize their cash positions and ensure they have the funds needed to cover expenses and invest in growth.

7. Auditing and Accountability: In cases of internal or external audits, accounting software simplifies the process by providing a detailed and organized record of financial transactions. This transparency promotes accountability and can be crucial in demonstrating compliance with financial regulations.

8. Accessibility and Collaboration: Cloud-based accounting software offers accessibility from anywhere with an internet connection. This facilitates collaboration among team members, accountants, and stakeholders, ensuring that everyone has access to real-time financial data.

9. Cost Control: By tracking expenses and analyzing financial reports, businesses can identify areas of unnecessary spending and implement cost-saving measures. Accounting software helps control expenditures and improve financial efficiency.

10. Scaling and Growth: As businesses expand, their financial complexities increase. Accounting software can scale with the business, accommodating additional transactions, users, and features, ensuring that financial operations remain efficient even during periods of growth.

In summary, accounting software is an invaluable tool that streamlines financial processes, enhances accuracy, and provides the insights needed for informed decision-making. It is an essential component of successful business operations, enabling businesses to achieve financial stability, compliance, and long-term growth.